How did the prediction markets see Tim Walz?

And what does that mean for their predictive ability for November

Vice President Kamala Harris chose Minnesota Governor Tim Walz as her VP candidate yesterday. Others are writing about Walz’ record as a congressman and governor (and I’m still waiting for the Manning brothers to break down the tape of his high school football games) or whether he’ll help or hurt the ticket.

I wanted to investigate what this pick shows for one of the subjects of my recent presentation on forecasting the presidential race: did prediction markets get this call right? And if so, should we give them more credence for November?

What did the markets think?

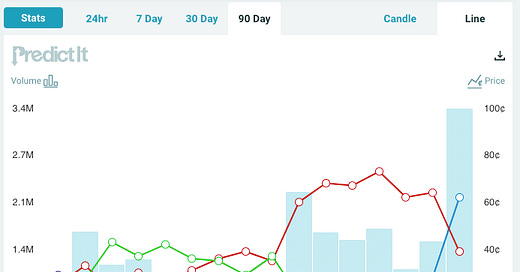

Here’s what some of the prediction markets said. First, PredictIt

You can see that Kelly, in light green, was the favorite in the first days after Biden dropped out, close to Shapiro, who took a commanding lead in the past couple weeks as his name was floated as one of the final contender.

Walz was not the favorite until yesterday, when he overtook Shapiro, who took it back this morning. At the time of the announcement, Walz was at 36%.

On Polymarket, it’s was even a longer shot. Walz was around 25% when the late movement happened.

Before then, Shapiro had been the leading contender for most of the past couple of weeks, with Arizona Sen. Mark Kelly also the most probable for a time before that, and Andy Beshear having some blips, including one moment when he spiked to 47%.

So were they right?

Based on the prediction markets, the story of the veepstakes were:

1. Biden drops out an it’s clear that Harris will chose a white man. There’s no clear favorite.

2. Mark Kelly is the favorite. But Andy Beshear is getting some attention, too. Still no absolute certainty.

3. Josh Shapiro looks like the choice. It’s not as high a likelihood as Harris becoming the presidential nomination once Biden dropped out, but it’s maybe more akin to the markets during the 2020 race, with one candidate consistently the most probable in a divided field.

4. Public reporting suggest that it’s down to Walz and Shapiro, with the other candidates fading.

5. Unexpectedly, Walz is chose.

Largely, I think that was the correct story. Anyone who was closely following the selection process could tell you that Shapiro, Kelly, Cooper, Beshear, and Buttigieg were the names first discussed. Walz later emerged, but he was never the most probable.

As Josh Marshall of Talking Points Memo put it:

My first reaction was shock that it was Tim Walz and not Josh Shapiro. Not “shock,” disappointment, or “shock,” it was a bad decision. But “shock” in the simple sense that I really thought it was pretty much definitely Shapiro for the last week. There were lots of reasons I thought this but what sort of sealed it was hearing that Harris would do the roll out in Philadelphia. Just didn’t add up to me she’d roll out anyone but Shapiro in the state where he’s governor and in what is essentially his home town.

In that sense, the prediction markets were right. They correctly tracked the varying levels of probability for multiple outcomes of an uncertain event.

What does it mean for November

The veepstakes are an almost perfect use case for prediction markets. It’s impossible to create a statistical model for them, since polling doesn’t really matter and there’s not much historical data. And it can be fast-moving, with a single great TV hit propelling a candidate into contention.

Yet all that means is that we distill the wisdom of the crowds (or conventional wisdom, to be less charitable) into a number. It’s better than asking a single analyst, who may be idiosyncratic or flat-out wrong, but it doesn’t mean that it’s necessarily going to be predictive. There was $128 million bet on the VP market on Polymarket, and only $12.9 on Walz. A lot of people lost a lot of money yesterday, which makes you wonder why we would listen to them.

To me, this episode shows that prediction markets are a useful guide to what’s happening in a situation, and can often save you time parsing through anonymous quotes in the 10th paragraph of a Politico story. If you’re only loosely following the news, you can check in on them and see if anything dramatic has shifted and, if so, it’ll justify a few minutes reading more.

For the presidential race, I wouldn’t expect them to be uniquely predictive, but I do expect them to be the first forecasting tool to incorporate news into their outputs.

The real value of these markets are your ability to become a better forecaster yourself. If you start making your own predictions - not even on these markets, but simply by writing down the probabilities of what you think might happen - and then go back and interrogate what you got right and wrong, you’ll very quickly start to improve your forecasting.

Get in touch if you want to learn more about that process.